The Dreaded Chargeback

ClubReady Fitness

January 24, 2018

You’re happily growing your business—signing up new members and growing your draft—when bam, you see a negative amount show up on your remit or merchant statement.

You didn’t provide this member with a refund, so what could this be? Meet the dreaded and largely misunderstood, chargeback. Unfortunately, this little hurdle is a part of running a business. And like most things in business and life, the more you know about it and the process behind it, the better off you’ll be.

Let’s start with the definition for a chargeback. A quick Google search provided this handy definition. “A demand by a credit-card provider for a retailer to make good the loss on a fraudulent or disputed transaction.” Simply put, it provides the consumer protection and a pathway for recovering charges that they don’t believe are justified. So why do members chargeback payments? There is a litany of reasons. Perhaps they don’t believe they are getting the services they were promised. Maybe they think they’ve properly canceled their contract yet are still being charged. Possibly they want to cancel and are being held to the terms of their agreement (which you’re validly enforcing). Whatever the reason, when members initiate chargebacks, they’re basically saying, “I’m not going to take responsibility for paying this charge on my card because I don’t think it’s valid.”

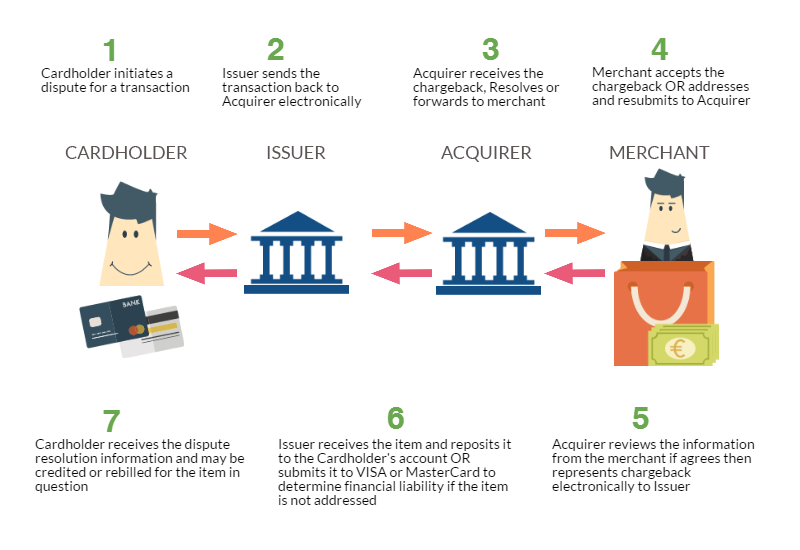

HOW DOES THE CHARGEBACK PROCESS WORK?

The process begins when your member, the cardholder, “files a chargeback” – this means the cardholder notifies his or her bank of a transaction alleged to be in error. The cardholder’s bank (called the “issuing bank”) usually has its own internal process for pre-screening a disputed charge, and, if the issuing bank finds the charge to be valid, the cardholder will be charged. Typically, a processing fee is added. If, however, the issuing bank finds sufficient evidence to support the cardholder’s claim, it will open a file, notify the merchant’s bank of its findings, and temporarily re-credit any disputed funds to the cardholder’s account pending the outcome of the dispute. The merchant bank will then do its own investigation. As part of this process, the merchant bank may collect evidence in support of a disputed charge. Where the merchant bank deems the evidence collected as sufficient, it will present its findings, and the proof, to the issuing bank. If the issuing bank approves the merchant bank’s findings, the cardholder loses, and he or she will be liable for the charges and any associated fees. If, however, the issuing bank disagrees with the merchant bank’s findings, then the cardholder wins, and the recredited amounts will stick – the cardholder will not be liable for the charges.

HOW LONG DOES IT TAKE TO RESOLVE A CHARGEBACK?

Resolution of chargeback disputes can take anywhere from six weeks to six months. We generally see chargeback disputes resolved in about 45 to 60 days. This is a complex process that involves multiple parties; it’s not something that resolves quickly.

IS THERE ANYTHING I CAN DO TO BETTER MY CHANCES OF WINNING?

Glad you asked. Yes, there absolutely is. Keep in mind; the ability to defend yourself in a chargeback dispute will only be as good as the evidence you can present. And gathering that evidence starts at the club level. What you need, more than anything, is documentation which tends to prove the legitimacy of a charge. This could include:

- A signed and dated Membership Agreement, or PT Agreement, showing the cardholder as the “Buyer.”

- A written notice of cancellation signed and dated by the cardholder, detailing the reasons for cancellation.

- A checklist signed and dated by the cardholder showing receipt of legal agreements, or acknowledgment of key provisions.

- Email correspondence between you and the cardholder regarding the substance of the disputed transaction.

- The cardholder’s check-in history or PT session bookings log.

- Any notes in your club management system as it relates to a disputed transaction.

In addition, here are a few more best practices you can follow:

- The more you can resolve through customer service channels, the less likely it will be that you get hit with chargebacks. Take the time to properly train your customer service teams.

- Be thorough and complete in your approach to getting agreements signed. Make sure names are correct, payment terms are correct, and cancellation policies are clearly stated and adequately explained.

- Make sure the name on the credit card used by your member or client to pay for services matches the name on the agreement, whether as the “member” or the “buyer.”

- If you change your business practices in a way that materially changes your products or services, you should notify all members in advance of the change and, in some cases, get signed agreement modifications or new agreements altogether.

- Don’t load pictures (i.e., .jpg) of contracts to the system. What you need is the actual signed agreement as a PDF document.

- Please make sure all documentation is legible, and that there are no blank spaces in contracts.

- If you’re in a chargeback dispute, please respond to all requests for more information as quickly as possible. A delay could result in a missed deadline and a lost chargeback.

Chargebacks aren’t always fair, and the decisions made by the member’s issuing bank may not be just either. Remember, even when you do everything right, there is always a chance a member will chargeback a payment and win. In the end, you have to chalk these instances up to the cost of doing business. The goal is to limit the number of chargebacks you have to fight and when you do face a chargeback, to have a full arsenal of facts and documents at your disposal to fight it.

Don’t want to handle the chargeback process on your own? Find help. Several club management softwares offer solutions that will manage the chargeback process for you. ClubReady’s fully managed software and billing platform takes this burden off your shoulders and works to fight any disputed charges on your behalf. To learn more about this feature or the other solutions ClubReady offers, visit www.clubready.com. In addition to billing assistance, ClubReady can also assist with other core back-office functions such as accounting, payroll, HR, operations, and customer service through their professional service division, GYM HQ.

BUILD YOUR BUSINESS STRENGTH—GET A COMPLIMENTARY BUSINESS ANALYSIS

Discover how you can maximize your operations, minimize risks, and reduce costs to build your business strength and create #members4life.